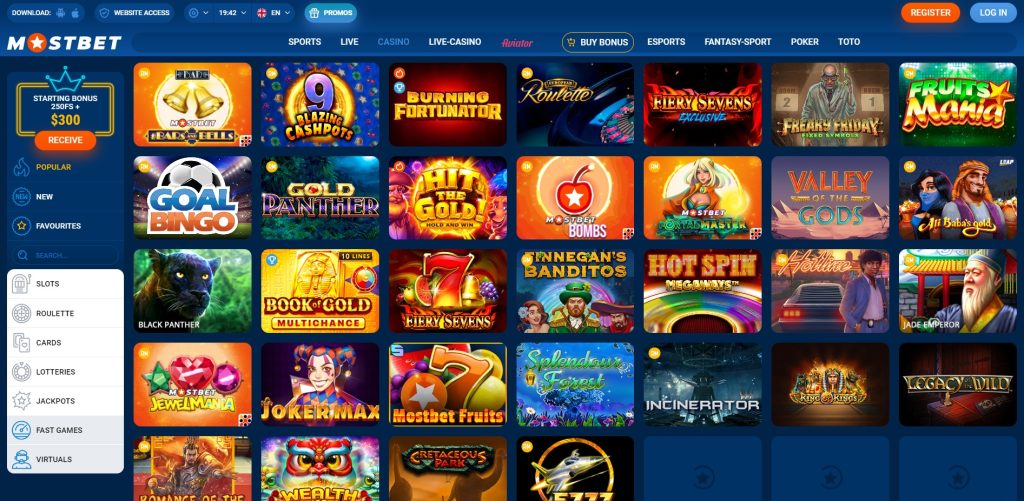

The last decade has witnessed a monumental shift in the way we perceive and engage with money. The rise of cryptocurrency has revolutionized the financial landscape, transforming traditional notions of banking, investing, and commerce. This digital currency has opened the doors to a decentralized economy, enabling individuals to transact without intermediaries. The explosive growth of Bitcoin and other cryptocurrencies has captured global attention, with new projects and innovations emerging almost daily. In this article, we will explore the factors contributing to the rise of cryptocurrency, its impact on the global economy, the challenges it faces, and what the future holds for this digital financial phenomenon. Additionally, you can find opportunities in the realm of cryptocurrency through The Rise of Cryptocurrency in Bangladesh’s Online Casino Scene Mostbet partner.

Understanding Cryptocurrency

At its core, cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (known as fiat currency), cryptocurrencies are decentralized and typically based on blockchain technology—a distributed ledger that records all transactions across a network of computers. Bitcoin, the first and most well-known cryptocurrency, was introduced in 2009 by an anonymous individual (or group) known as Satoshi Nakamoto. Since then, thousands of alternative cryptocurrencies (often referred to as altcoins) have emerged, each with unique features and use cases.

Factors Contributing to the Rise of Cryptocurrency

1. Technological Advancements

The proliferation of technology has been a key driver in the rise of cryptocurrency. The emergence of blockchain technology, which provides the backbone for most cryptocurrencies, has enabled secure, transparent, and efficient transactions. The Internet and mobile technologies have also played a vital role in making cryptocurrency accessible to a global audience. As smartphones and internet access became widely available, the ability to transact in cryptocurrency was democratized, allowing more people to engage with this new financial system.

2. The Quest for Financial Independence

In a world where trust in traditional financial institutions is declining, many individuals are seeking alternatives to attain financial independence. Cryptocurrencies provide an opportunity to bypass traditional banking systems, enabling people to hold, transfer, and invest their wealth without reliance on intermediaries. This self-sovereignty over personal finance has attracted a growing number of individuals who aspire to take control of their financial futures.

3. Investment Opportunities

The rise of cryptocurrency has also been fueled by investment interest. Early adopters of Bitcoin and other cryptocurrencies have seen phenomenal returns on their investments, leading many to view cryptocurrency as a new asset class. The allure of high potential returns has attracted retail and institutional investors alike, leading to the proliferation of cryptocurrency exchanges and the development of complex financial products and services such as futures and exchange-traded funds (ETFs).

Impact on the Global Economy

The growing adoption of cryptocurrency is reshaping the global economy in various ways. Firstly, it is challenging established financial systems by introducing decentralized alternatives. For example, decentralized finance (DeFi) platforms allow users to lend, borrow, and trade without the need for banks. This can reduce costs and increase efficiency in financial transactions.

Secondly, cryptocurrency can facilitate cross-border transactions more efficiently than traditional banking systems. International remittances often involve high fees and lengthy processing times. Cryptocurrencies can streamline these transactions, providing users with a faster and cheaper alternative to move money across borders. This is especially beneficial for individuals in developing countries who may lack access to traditional banking services.

Furthermore, the rise of cryptocurrency has sparked innovation in various sectors, including technology, finance, and supply chain management. Companies are exploring the integration of blockchain technology to enhance transparency and efficiency in their operations, which could lead to significant economic benefits in the long term.

Challenges Facing Cryptocurrency

1. Regulation

One of the most significant challenges facing the cryptocurrency industry is regulatory scrutiny. Governments around the world are grappling with how to regulate cryptocurrencies and ensure consumer protection while fostering innovation. Striking the right balance is crucial, as excessive regulation could stifle growth in the sector, while insufficient regulation may lead to fraud and market instability.

2. Security Concerns

Security is another pressing issue within the cryptocurrency space. While blockchain technology is considered secure, crypto exchanges and wallets are not immune to hacking and theft. High-profile hacks have led to substantial losses for investors, raising concerns about the safety of holding digital assets. Improving security measures and increasing consumer awareness about best practices for safeguarding cryptocurrencies is essential for building trust in the industry.

3. Market Volatility

The cryptocurrency market is notorious for its volatility. Price fluctuations can be extreme, with significant gains and losses occurring within short periods. This volatility can deter potential investors and users who may be hesitant to engage with assets that experience such dramatic price swings. Addressing the perception of cryptocurrencies as speculative investments is crucial for fostering mainstream adoption.

The Future of Cryptocurrency

Despite the challenges, the future of cryptocurrency looks promising. Experts predict that as technologies continue to develop, cryptocurrencies will become more widely accepted as a legitimate form of payment. Major companies, including PayPal and Tesla, have already begun accepting cryptocurrencies, signaling a shift towards mainstream adoption.

Furthermore, as regulatory frameworks mature, institutions may feel more comfortable entering the cryptocurrency space. This influx of institutional investment could stabilize the market and further legitimize digital assets in the eyes of the public.

Moreover, innovations within the blockchain ecosystem, such as non-fungible tokens (NFTs) and decentralized autonomous organizations (DAOs), suggest that the potential applications of cryptocurrency and blockchain technology extend far beyond simple financial transactions. These developments could usher in a new wave of digital innovation and entrepreneurship, reshaping various industries.

Conclusion

The rise of cryptocurrency marks a significant shift in the financial landscape, challenging traditional systems and creating new opportunities for individuals and businesses alike. Although there are challenges to be addressed, the potential for cryptocurrency to empower individuals and transform the global economy is immense. As technology continues to evolve and regulatory frameworks are established, we may witness a future where cryptocurrencies are an integral part of the financial ecosystem, paving the way for greater financial inclusion and innovation across the globe.